Mistakes can be detected easily through verification, and entries are kept up to date, as the balance is verified daily. By contrast, balances in cash accounts are commonly reconciled at the end of the month after the issuance of the monthly bank statement. A petty cash book is an account or record of all petty cash expenses of your business.

Simple Petty Cash Book Vs Analytical Petty Cash Book

Visit What is a Petty Cash Voucher for more information and an example of a completed voucher. Using a petty cash book is critical to ensuring that petty cash is sufficient and properly spent. Although paper-based petty cash books may be sufficient for certain transactions, digital petty cash books offer many advantages. For example, the conversion increases security, minimizes the risk of loss and damage, and prevents unauthorized spending.

Importance Sources of Accounting Documents

It covers the small, day-to-day costs of running a business without extra delays or paperwork. But without a clear system, it can get tricky to keep track of where the expenses are coming from. The petty cash helps accountants to process some small and routine payment without authorization from top management. Accountants need to use petty cash as the suppliers do not allow to purchase on credit.

What Is the Difference Between a Cash Book and a Cash Account?

In the petty cash policy document, we should state that the petty cash fund is $500 with Heather Smith as the custodian. She should also sign the document to transfer the petty cash fund accountability to her. The petty cash custodian will keep all petty cash items inside a lockbox. Only the custodian can access the lockbox—and it mustn’t be left opened and unattended.

Free Course: Understanding Financial Statements

There might be errors in data entry or compliance issues that are causing trouble in the finances of the company. Maintaining compliance with financial regulations, whether it is internal or external, is of utmost importance. The manual nature of petty cash bookkeeping increases the likelihood of inadvertent errors, making businesses susceptible to compliance issues that may arise during audits.

- Petty cash books are prepared using the ordinary system and imprest system.

- The chief cashier records petty cash advances to the petty cashier on the credit side of the cash book as “By Petty Cash A/c”.

- Additionally, the admin department is also responsible for such kinds of expenses.

- With clear policies, diligent record-keeping, and regular reviews, your petty cash fund can truly become your small business’s secret weapon for financial agility.

Streamlines the recording process for minor transactions, saving time and effort compared to more formal accounting procedures. The business owner or finance department provides the initial amount of money to start the petty cash fund. Decide on the amount of money to be kept in the petty cash fund, considering the frequency and nature of small expenses. Particular where are selling and administrative expenses found on the multi cash that is used to pay for day-to-day petty expenses in a firm is called petty cash. In this, the finance team can be sure of the number of expenses of the same nature for a particular period. Let’s say that at the end of the month, you have $49.15 remaining in your cash box, and you want to top your petty cash fund by $150.85 to get it back up to $200.

To create a petty cash fund, a check is written to cash for a set amount such as $75 or $100. Determining the right amount of petty cash for your business is crucial for maintaining efficiency without exposing yourself to unnecessary risk. By allocating a fixed amount to a sundry fund, businesses can better control and predict small-expense spending.

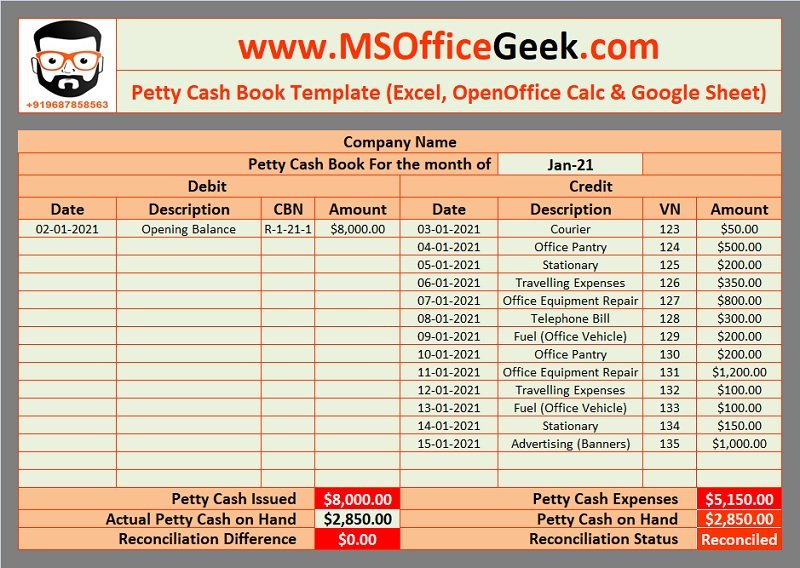

Establish a detailed bookkeeping system to record each petty cash transaction. Doing so can also later help in transferring all the details to your accounting system. The system should capture essential details such as date, purpose, amount, and receipts.

Regular reconciliation transforms data into insights, offering a nuanced understanding of spending patterns. This knowledge becomes a strategic asset, allowing organizations to make informed decisions and adjust budgets based on observed trends in petty cash expenditures. Financial policies and procedures form the backbone of responsible financial management. The imprest system’s requirement for periodic fund replenishment ensures that the petty cash remains adequately funded, preventing shortages and disruptions in operational activities.